Trending Multifamily News

STANDARD COMMUNITIES ACQUIRES $1 BILLION PORTFOLIO IN LARGEST AFFORDABLE HOUSING TRANSACTION OF 2024

Standard Communities, a major national affordable housing developer and investor, has acquired a 100% affordable housing portfolio valued at over $1 billion consisting of over 6,000 apartment homes in more than 60 communities in four states.

Standard’s national portfolio has expanded to nearly 27,000 apartment homes, providing stable housing for approximately 60,000 residents.

With this transaction Standard enters three additional states—Arizona, Colorado and Texas—while significantly growing its California portfolio to nearly 11,000 apartment homes.

Home to over 13,000 residents, the more than 60 communities in the portfolio serve a mix of families and seniors. The properties, on average, were built in 2002 and a majority were developed by the seller.

Standard will invest over $30 million in capital improvements and deferred maintenance across the portfolio with no residents being displaced to ensure the communities remain affordable and resilient for years to come.

“In a market environment considered challenging, Standard is experienced and well positioned to finance and complete large and highly complex multi-state acquisitions relying on the skills, creativity and knowledge of our team,” said Jeffrey Jaeger, Co-Founder and Principal at Standard Communities. “Our strategic planning in this difficult interest rate environment has allowed us to enter into new states, greatly expand our portfolio and continue to invest in people’s futures by offering them affordable places to live."

Standard led public-private partnerships with multiple government agencies including HUD, Fannie Mae, Freddie Mac, state governments in Arizona, California, Colorado and Texas and several local housing authorities to preserve long term affordability through the various federal, state, and local programs in place across the projects including Low Income Housing Tax Credits.

“Our unique acquisition underscores the complexity and scale that our team managed in a challenging environment in both the debt and equity capital markets,” said Chris Cruz, Senior Managing Director, Essential Housing at Standard Communities.

“We took control of these properties by acquiring general and limited partnership interests, including controlling interests of managed tax credit funds with institutional investors. It also included the purchase of various third-party subordinate notes to optimize partnership economics. We navigated new financing facilities, tax credit investor partners, non-profit partners, ground lease buyouts and loan assumptions with numerous governmental and private lenders simultaneously on a fixed timeline. This required our highly coordinated efforts, deep expertise and focus on our mission to create more vibrant, sustainable and affordable communities,” said Mr. Cruz.

He added, “We are actively pursuing additional large-scale opportunities like this. We’re uniquely positioned to handle sizable portfolios amid increasing consolidation within the industry. We expect portfolio acquisitions to continue to play a key role in our growth, and we have significant capital ready to support these strategic investments.”

Based in New York and Los Angeles, Standard has a portfolio of nearly 27,000 apartment units and more than $5 billion in assets under management across 21 states and Washington, D.C. With expertise in development, acquisitions, renovations and construction, Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.

Standard Communities, a leading national multifamily affordable housing investor and developer, is making its entry into Michigan, in a joint venture with River Caddis Development participating in a public private partnership creating a ground-up affordable community in Kalamazoo.

The public private partnership includes the Michigan State Housing Development Authority, Kalamazoo County and the City of Kalamazoo. WNC & Associates is the equity partner.

The development, River’s Edge, is capitalized at $56 million.

"Our first investment in Michigan, the development of River’s Edge in Kalamazoo, is a significant step forward in our mission to create vibrant, sustainable communities that provide high-quality affordable housing for families. The collaboration with our public and private partners is instrumental in making this a reality, and we look forward to expanding our work in Michigan," said Jeffrey Jaeger, Co-Founder and Principal of Standard Communities.

River’s Edge will have 228 units, with 184 affordable for those earning 60% or less of the Area Median Income (AMI.) The additional 44 units are for those with incomes under 120% of AMI. Affordability is made possible by Low Income Housing Tax Credits.

Located at 508 Harrison Street and 660 Gull Road, River’s Edge is comprised of two parcels totaling 7.4 acres northeast of downtown Kalamazoo. The community will include two 4-story multifamily buildings, a 4-unit live/work building and a commercial building featuring a leasing office and such resident amenities as a fitness center, playground and outdoor terraced patio. The community will have access to pedestrian paths connecting with the 35-mile Kalamazoo River Valley Trail.

“This northside neighborhood of Kalamazoo is undergoing an unprecedented revival with an appealing mix of businesses, shops, restaurants and affordable apartments. The area is being transformed from an industrial and commercial district into a residential, live-work-play community within walking distance from downtown Kalamazoo,” said Robert Koerner, Chief Investment Officer at Standard Communities.

The property will be National Green Building Standard Silver-certified, meaning it is designed and built to achieve high performance in site design, resource efficiency, water efficiency, energy efficiency, indoor environmental quality, and operation and maintenance.

"We are thrilled to bring this new affordable housing project to Kalamazoo," said Kevin McGraw, CEO of River Caddis Group. "At River Caddis Communities, our goal is to create

homes that provide opportunity and stability for residents, and this project represents a significant step toward achieving that. We are excited to work with Standard and local partners to ensure that this development has a lasting, positive impact on the Kalamazoo community."

Based in New York and Los Angeles, Standard has a portfolio of over 20,600 apartment units and $4.4 billion in assets under management across 18 states and Washington, DC. With expertise in development, acquisitions, renovations and construction, Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.

River Caddis Communities is the mission-driven affordable housing division of River Caddis Group, a full-service real estate development and advisory firm based in Lansing, Michigan. Focused on building sustainable and inclusive communities, River Caddis Communities provides affordable housing options to ensure that everyone, regardless of income, can find a quality home. River Caddis Group has successfully developed projects across various sectors, including multifamily housing, retail, office, and mixed-use developments. With a solutions-based approach, River Caddis Group fosters strong public-private partnerships to create impactful and lasting developments.

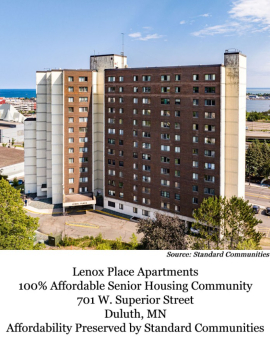

Standard Communities, a leading national multifamily housing investor and developer, has made its second investment in Minnesota in a month, acquiring a 100% affordable community in Duluth.

Standard led a public-private partnership in acquiring the 152-unit Lenox Place Apartments at 701 W. Superior Street in Duluth. Built in 1980, Lenox Place has 143 one-bedroom units and nine two-bedroom units for seniors and individuals with disabilities.

The transaction is capitalized at $37.14 million.

Standard will extend the affordability of Lenox Place Apartments for 30 years, with resident income restricted to 60% of the Area Medium Income.

Standard recently made its first investment in Minnesota, acquiring Rivertown Commons, a 96 unit 100% affordable senior community in Stillwater, in a transaction capitalized at $27.7 million.

Funding for the Lenox Place Apartments transaction included Low Income Housing Tax Credits secured through the Minnesota Housing Finance Agency and the Housing Redevelopment Authority of Duluth issued tax exempt bonds. Huntington Bank provided the Tax Credit equity.

Standard will significantly renovate the 14-story property at a cost of approximately $12 million. Residents will not be relocated during renovations, which include extending the sprinkler system into units, installing new carpet and flooring and painting unit interiors. Bathroom vanity lighting will be replaced and new supply lines and low-flow toilets installed. Other unit interior upgrades include the addition of countertop microwaves in the kitchens and a pull cord system installation.

Standard will address building system deferred maintenance including new roofing, replacing a standby emergency generator, repairing railings and replacing smoke and CO detectors.

New resident amenity spaces will be created, including a fitness center, a business center and storage lockers. Common areas will be improved with new flooring, LED lighting and paint. Façade upgrades and concrete and asphalt repairs will be made, and exterior lighting improved. A resident services coordinator will be assigned to the property.

“Lenox Place, our second affordable housing investment in Minnesota, will continue to offer homes to seniors and individuals with disabilities in an appealing and engaging living environment,” said Jeffrey Jaeger, Co-Founder and Principal of Standard Communities. “Every

community that we invest in revives and strengthens neighborhoods and provides new opportunities for residents to live affordably for years to come,” said Mr. Jaeger.

“It is critical that we invest in housing that allows residents to live independently with access to the life-enhancing resources and amenities they need to thrive,” said Robert Koerner, Standard’s Chief Investment Officer. “We will continue to seek additional affordable housing investments in Minnesota so we can provide more individuals with an affordable place to call home,” he added.

Based in New York and Los Angeles, Standard has a portfolio of over 20,000 apartment units and $4.4 billion in assets under management across 17 states and Washington, DC. With expertise in development, acquisitions, renovations and construction, Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.

Standard Communities, a leading national multifamily housing investor and developer, has made its first investment in Minnesota, acquiring Rivertown Commons, a 96-unit 100% affordable community for seniors and individuals with disabilities in Stillwater.

The transaction is capitalized at $27.8 million.

Standard completed the acquisition in partnership with the Washington County Community Development Agency and the Minnesota Housing Finance Agency (MHFA). Huntington Bank provided the tax credit equity.

Standard will preserve and extend the affordability of Rivertown Commons, with resident income restricted to 60% of the Area Medium Income.

Located at 212 2nd Street North in Stillwater, the affordable senior community was built in 1978 and previously renovated in 2007. It features one and two-bedroom units.

“Half of all renters in Minnesota are cost burdened, and rents continue to rise. We are excited to combine our experience as owners in 17 states and Washington, D.C. with Minnesota's best practices to address the pressing need for affordable housing,” said Jeffrey Jaeger, Co-Founder and Principal of Standard Communities.

“For seniors living on fixed incomes, it has become increasingly difficult to afford a quality home. With our investment in Rivertown Commons, we are protecting a critical resource for seniors. We are committed to long-term ownership that supports the residents and the community,” Jaeger added.

Standard plans a nearly $9 million renovation of Rivertown Commons, which includes adding a second elevator and upgrading and modernizing various building systems. A 100-kW solar panel system will be added that will generate 112.5 MWh of clean energy annually, lowering the property's carbon footprint by 86.6 tons of CO2e each year. Standard will also add a Resident Services Coordinator at the property who will design and implement a comprehensive suite of resident services and programs.

“There is a strong demand for senior affordable housing in Washington County,” said Robert Koerner, Standard’s Chief Investment Officer. “Partnering with state and county agencies in this transaction exemplifies the vital role of public-private partnerships in addressing the affordable housing crisis, and encourages Standard to seek additional investments in Minnesota,” he added.

"We are pleased to work with the City of Stillwater, Washington County Community Development Agency and the Minnesota Housing Finance Agency (MHFA) to maintain and extend the affordability of Rivertown Commons, an essential component of Stillwater's affordable housing," said Thomas Marro, Vice President of Acquisitions & Redevelopment at Standard Communities.

Based in New York and Los Angeles, Standard has a portfolio of over 20,000 apartment units and $4.4B in assets under management across 17 states and Washington, DC. With expertise in development, acquisitions, renovations and construction, Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.

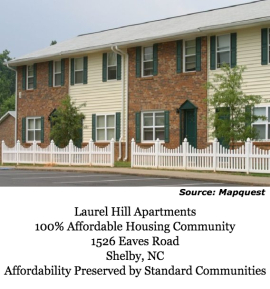

Standard Communities, a leading national multifamily housing investor and developer, has made its second investment in North Carolina, acquiring a 100% affordable community in Shelby.

Standard led a public-private partnership to acquire Laurel Hill Apartments at 1526 Eaves Road in Cleveland County. Built in 1974, Laurel Hill has 100 units ranging in size from one to three bedrooms.

The transaction is capitalized at $16.4 million.

In 2017 Standard Communities acquired Arrowhead Apartments in Asheville, NC, a 116-unit affordable community.

“Standard continues to focus on ways that we can preserve and create affordable housing through strong public-private partnerships,” said Tommy Attridge, Standard’s Vice President of Acquisitions and Redevelopment, based in Charleston, SC.

Funding for the Laurel Hill transaction included Low Income Housing Tax Credits secured through the North Carolina Housing Finance Agency. Fannie Mae and Regions Bank also provided financing. The public-private partnership also included HUD.

Standard will significantly renovate Laurel Hill Apartments at a cost of $100,000 per unit, “with a very comprehensive rehab including addressing deferred maintenance and updating features in the units and amenities for residents,” said Mr. Attridge.

“Laurel Hill is Standard’s sixth investment in the Carolinas, bringing our portfolio in North and South Carolina to 840 units, enabling Standard to improve the quality of life of residents of these communities,” said Jeffrey Jaeger, Co-Founder and Principal of Standard Communities. “This is consistent with Standard’s mission of expanding access to high quality affordable housing throughout the United States. We are committed owners for the long term and look forward to future investments in North and South Carolina,” said Mr. Jaeger.

“Affordable housing is a critical component of strong communities. Regions Bank is grateful for the opportunity to partner with Standard Communities, NCHFA, and the many other stakeholders to help preserve safe and affordable housing in Shelby, NC,” said Graham Dozier, Managing Director, Regions Real Estate Capital Markets.

Based in New York and Los Angeles, Standard has a portfolio of over 20,000 apartment units and $4.4 billion in assets under management across 17 states and Washington, DC. With expertise in development, acquisitions, renovations and construction, Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.

Standard Communities, a leading national multifamily housing investor and developer, is developing a ground up 240-unit 100% affordable community in Woodbridge, VA.

The Prince William County project, Jefferson Plaza Apartments, is capitalized at approximately $67.5 million.

Nationally, Standard currently has more than 2,000 units in its new construction pipeline.

Funding for Jefferson Plaza Apartments was secured through Virginia Housing as the issuer of tax-exempt bonds, and Freddie Mac provided Low Income Housing Tax Credits through Hudson Housing Capital.

“Our investment in Woodbridge, VA, is consistent with Standard’s track record throughout the United States of creating high-quality affordable communities,” said Scott Alter, Co-Founder and Principal of Standard Communities. “At Standard, we have a passion for finding innovative solutions to build affordable housing that best serves residents and communities. We are excited to bring new affordable housing to Woodbridge,” said Mr. Alter.

Jefferson Plaza Apartments, at 1305 Jefferson Plaza, will comprise seven 3-story buildings with 147 one-bedroom and 93 two-bedroom units. The community, being built on a 7.6 acre site of a former shopping center, is a transit-oriented development in the Route 1 Corridor within walking distance of the Woodbridge Virginia Railway Express station and close to I-95, with nearby shopping, restaurants and more.

“There is a strong demand for affordable housing in high-cost communities like Woodbridge,” said Feras Qumseya, Standard’s Chief Development Officer. “Developing housing on the site of a former shopping center is not easy, requiring easements and rezoning. The support and assistance from Prince William County to facilitate the process was crucial.” he added.

The property will be income-restricted to 60% of the Area Medium Income, making the units affordable to middle-income families and essential workers.

Jefferson Plaza will feature 354 parking spaces for residents, a 3,000 square foot club room, co-working space, a fitness center, bike storage, a playground and recreational area, greenspace and a dog park. Residents will have direct access to an adjacent park to be built out as part of the project.

“Revitalizing the Route 1 Corridor has been one of my top priorities since being elected as the Woodbridge District Supervisor 4 years ago. The Jefferson Plaza Apartments are a key part of that revitalization effort,” said Jefferson County Supervisor Margaret Angela Franklin. “I would like to thank Standard Communities for investing in Woodbridge. I also would like to thank Christopher Shorter, Prince William County Executive, for the professional staff work that was involved in bringing this much needed project forward,” she added.

“We are proud to provide financing and vital housing tax credits that will help make the construction of 240 new apartment homes a reality,” said Janet Wiglesworth, Interim CEO of Virginia Housing. “Jefferson Plaza will provide an affordable, conveniently located, modern community for residents in Prince William County. It is a product of strong partnerships that have one goal in mind: to invest in the future of affordable housing in our communities.”

Based in New York and Los Angeles, Standard has a national portfolio of almost 20,000 apartment units and has completed more than $4.7 billion of affordable housing acquisitions, rehabilitation and development nationwide. Standard Communities strives to cultivate long-term public and private partnerships to produce and preserve high-quality, affordable and environmentally sustainable housing.